Zakat in Ramadan 2026 – Complete Guide for Muslims in India

Ramadan is the most blessed month in Islam — a time of fasting, reflection, and generosity. While Zakat can be given at any time of the year, many Muslims in India prefer to give their Zakat during Ramadan because rewards are multiplied and the needs of the poor increase significantly.

If you are searching for Zakat donations in India, this complete guide will help you understand how to give correctly and responsibly in Ramadan 2026.

What Is Zakat?

Zakat is an obligatory charity and one of the five pillars of Islam. Every eligible Muslim who meets the Nisab threshold must give 2.5% of their qualifying savings and wealth after one lunar year.

Zakat is not optional charity. It is a religious obligation.

In India, millions rely on Zakat during Ramadan to meet their basic needs — especially food, rent, and medical expenses.

Who Is Eligible to Receive Zakat?

Many people search: “People eligible for Zakat” before donating.

Zakat must be given to specific categories mentioned in the Quran, including:

- The poor (those without sufficient income)

- The needy

- People in debt

- Stranded travelers

- Individuals struggling to meet essential living costs

In the Indian context, eligible beneficiaries may include:

- Daily wage laborers below survival income

- Widows without financial support

- Orphan-led households

- Families unable to afford basic groceries

Zakat cannot be given to wealthy individuals or used for general infrastructure expenses.

Proper verification of recipients is essential.

Can Zakat Be Used for Iftar or Ramadan Food Kits?

One of the most common questions in India is:

“Can we use Zakat money for iftar?”

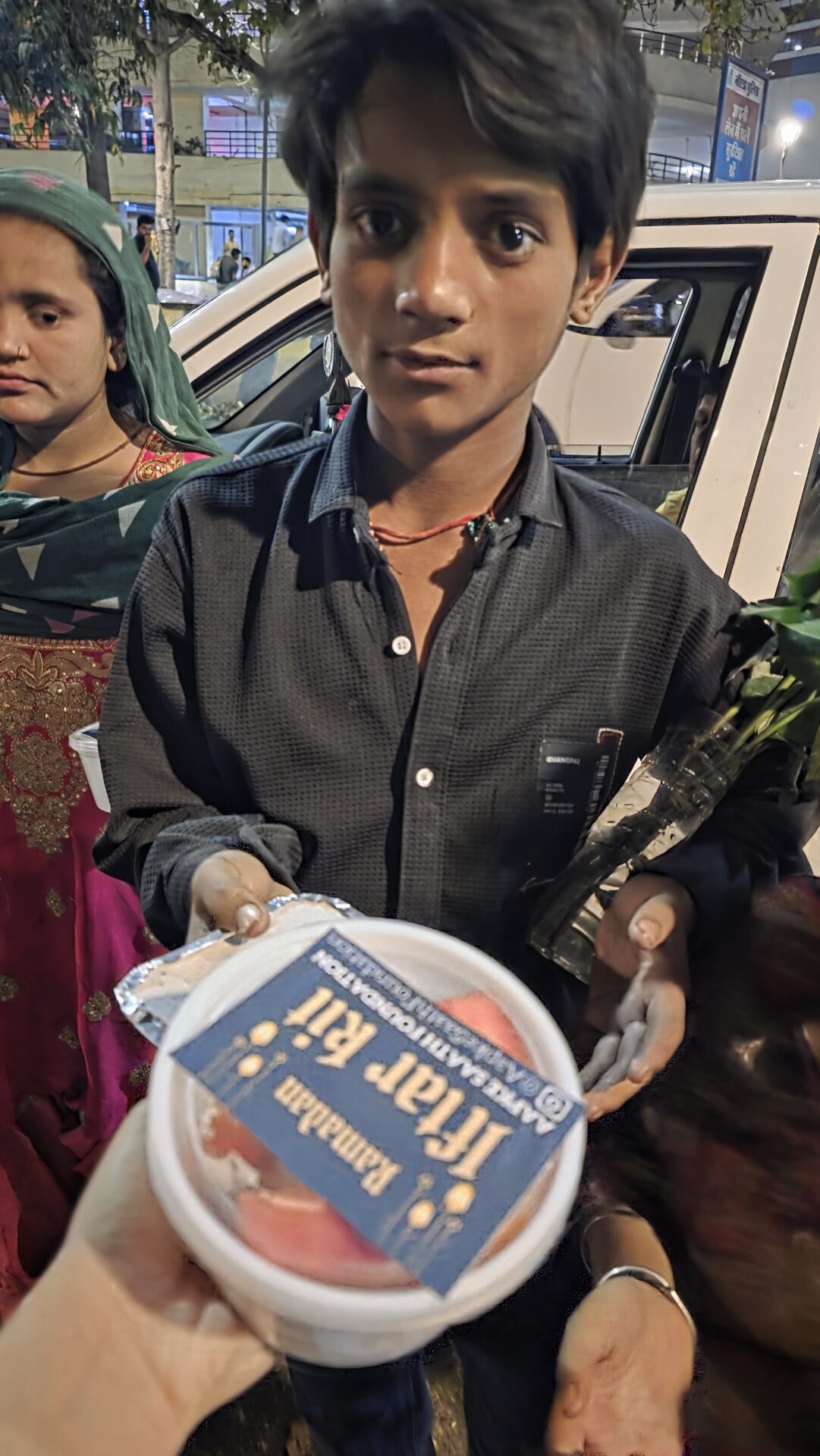

The answer is: Yes — if the recipients qualify as Zakat-eligible.

If Ramadan ration kits or iftar meals are distributed to families who are genuinely poor or needy, then Zakat funds can be used.

However:

- Zakat cannot be used for feeding financially stable people.

- It cannot be used for mosque construction.

- It must directly benefit eligible individuals.

Transparency and Shariah compliance are critical when giving Zakat in Ramadan.

Zakat vs Sadaqah – What’s the Difference?

Many donors confuse Zakat with Sadaqah.

Zakat

- Obligatory

- Fixed at 2.5%

- Strict eligibility rules

- Must go to specific categories

Sadaqah

- Voluntary charity

- Any amount

- Flexible usage

- Can support wider causes

If you are donating online in India, make sure you clearly select whether your donation is Zakat or Sadaqah.

Why Giving Zakat in Ramadan Helps Families in India

During Ramadan in India:

- Food prices increase

- Work opportunities decrease for daily laborers

- Many families struggle to prepare suhoor and iftar

Your Zakat can provide:

- Monthly Ramadan ration kits

- Iftar meal support

- Essential groceries

- Emergency relief

For a fasting mother with no income, your Zakat is not just charity — it is dignity.

How to Give Zakat in India Safely

Before making your Ramadan donation, ensure:

✔ The organization verifies beneficiaries

✔ Zakat funds are separated from general donations

✔ Distribution is transparent

✔ You receive confirmation of Zakat allocation

If donating online, confirm that the platform clearly labels Zakat donations separately.

Frequently Asked Questions About Zakat in Ramadan

Zakat can be given at any time once it becomes due. However, many Muslims in India choose to give Zakat during Ramadan because rewards are believed to be multiplied and the needs of poor families increase during this month. Giving during Ramadan allows donors to combine spiritual benefit with timely community support.

Yes, Zakat money can be used for iftar meals or Ramadan ration kits if the recipients qualify as Zakat-eligible (poor or needy). The funds must directly benefit individuals who meet Islamic eligibility criteria. Zakat cannot be used for general mosque expenses or for individuals who are financially stable.

Zakat in India can be given to individuals who fall under the Islamic categories of the poor and needy. This may include daily wage earners, widows without income, orphan-led households, families in debt, and those unable to afford basic food and essential living expenses. Proper verification of beneficiaries is important to ensure compliance with Islamic guidelines.

Zakat can be given through trusted Islamic charities and registered non-profit organizations that clearly separate Zakat funds from general donations and distribute them to eligible beneficiaries. Organizations such as Aapke Saath Foundation and other verified Indian charities conduct Ramadan ration kit and relief distributions for underprivileged families. Before donating, donors should review transparency practices, documentation, and beneficiary verification processes.

Zakat is an obligatory charity of 2.5% on qualifying wealth and must be given to specific eligible categories. Sadaqah is voluntary charity and can be given in any amount for broader causes. During Ramadan, many Muslims in India give both Zakat and Sadaqah to maximize spiritual reward and community impact.